An Airbnb rental, for example, can only deduct mortgage interest based on the period of time it has been rented out. So, if you were to only rent out for two months per year, that means you can only deduct 2/12 of your mortgage interest. A six-month rent will allow you to claim 50% and so on.. Landlord mortgage interest tax relief in 2024-25. Since April 2020, you've no longer been able to deduct any of your mortgage expenses from your rental income to reduce your tax bill. Instead, you now receive a tax-credit, based on 20% of your mortgage interest payments. This is less generous than the old system for higher-rate taxpayers, who.

Tax Deductible Mortgage YouTube

/CreatingaTax-DeductibleCanadianMortgage1_3-bbe7be25ea614913b8e8351756c52239.png)

Home Builder Construction Loan Interest Tax Deductible

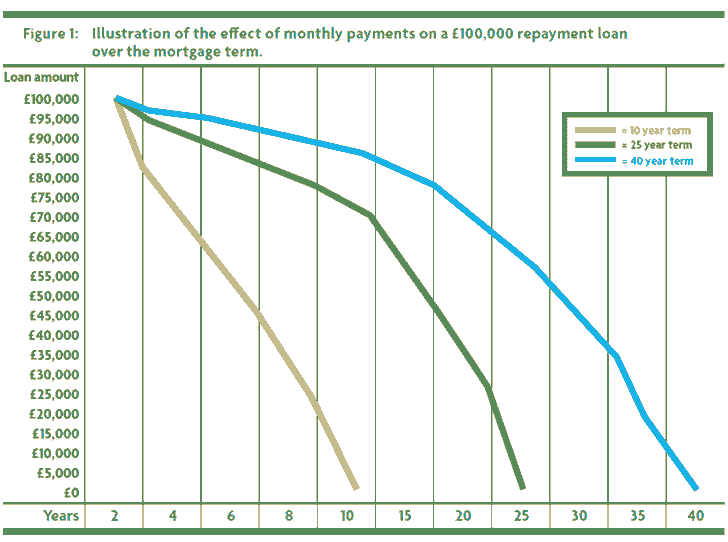

Mortgage Repayment Financial advisers, investment, wealth management and pensions advice

TAX DEDUCTIBLE MORTGAGE STRATEGY YouTube

Figure out how much your mortgage repayments on this property will be. Simply enter the details

How To Turn Your Mortgage in to Tax Deductible Mortgage Real Estate Tax Tips YouTube

![What Mortgage Repayment Methods Are the Best? [Property Education] YouTube What Mortgage Repayment Methods Are the Best? [Property Education] YouTube](https://i.ytimg.com/vi/E2vX_DTokeI/maxresdefault.jpg)

What Mortgage Repayment Methods Are the Best? [Property Education] YouTube

Deduction of Housing Loan Repayment and Interest PDF Tax Deduction Loans

3 Create a Tax Deductible Mortgage YouTube

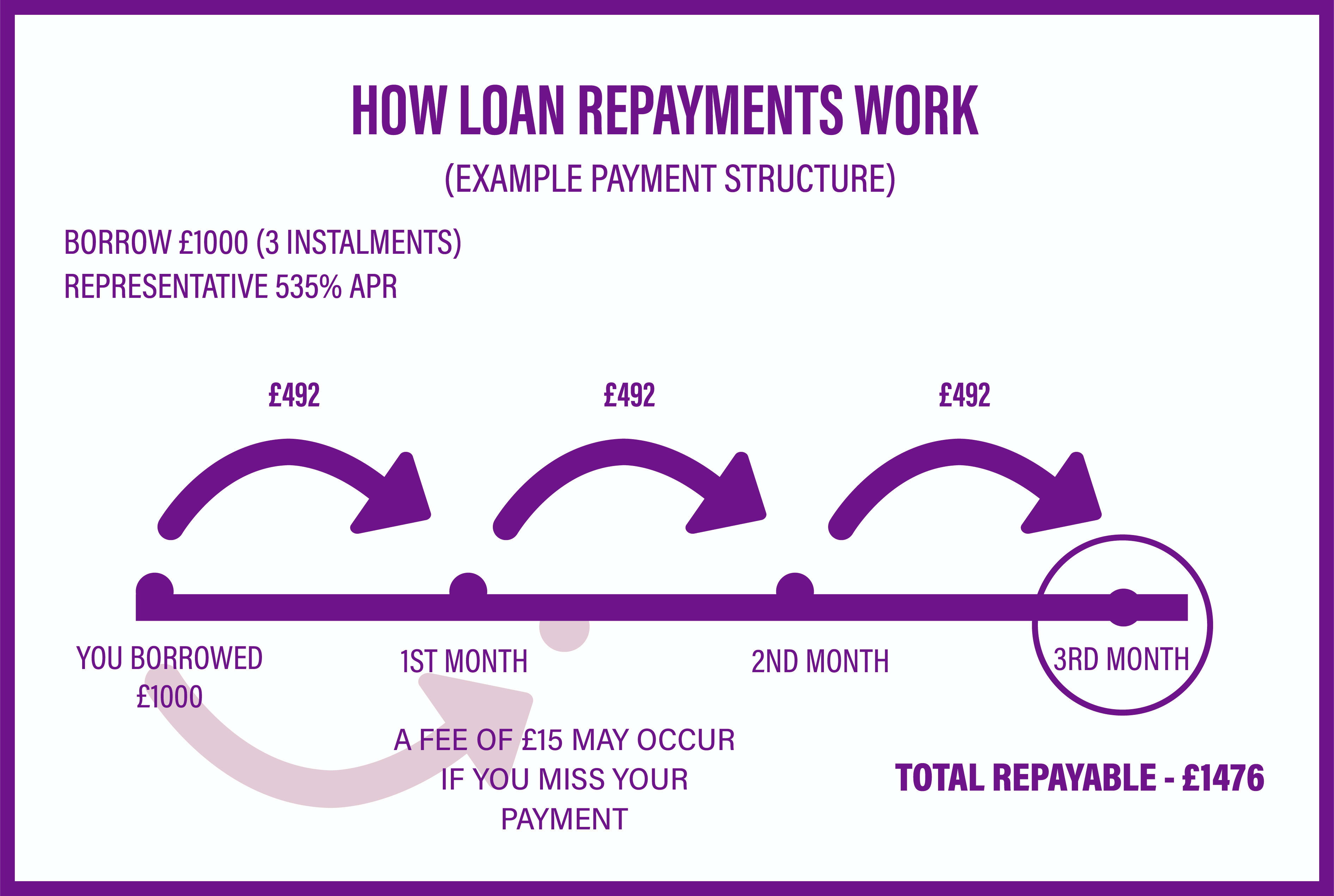

Short Term Loans Apply With CashLady Decision in 2 mins

Are Mortgage Points Tax Deductible? AZexplained

Creating A TaxDeductible Canadian Mortgage

How to Minimise Your Mortgage Repayments With Cashback

IS MORTGAGE INTEREST TAX DEDUCTIBLE? How does Mortgage Interest Tax Deduction Work? YouTube

:max_bytes(150000):strip_icc()/CreatingaTax-DeductibleCanadianMortgage2_3-32287bf83e94406aba3b1d625e6c295f.png)

Creating a TaxDeductible Canadian Mortgage

Mortgage Interest Tax Deductible 2023

Loan Repayments Tax Deductible Ppt Powerpoint Presentation Infographics Design Ideas Cpb

Are Mortgage Points Tax Deductible? Tax deductions, Amazon tax, Deduction

How do mortgage repayments work? Halifax

Which Mortgage and Homeowners’ Costs are Tax Deductible? Mortgage.info

The mortgage interest tax deduction is a deduction you can claim on the interest charged on your home loan if the property you bought with the loan is generating taxable income. Investment properties will qualify but no deduction is available for interest on your family home.. You can't deduct the repayments of the principal sum borrowed.. The short answer is: sometimes. It all depends on how the property is used. For a mortgage to be tax-deductible in Canada, the property the mortgage belongs to must be used for generating income (whether that's rental income, business or professional income). The good news is that primary residences that are also used in some rental capacity.